Transforming Data Into

Smarter Decisions Across Financial Institutions

AI-driven analytics, behavioral intelligence, and customer profiling to shape the future of financial institutions, retailers, mobility solutions, and public sector services.

Transforming Data Into

Smarter Decisions Across Financial Institutions

AI-driven analytics, behavioral intelligence, and customer profiling to shape the future of financial institutions, retailers, mobility solutions, and public sector services.

About AiGenix

AiGenix is a financial technology company specializing in advanced data analytics, AI/ML, and customer behavior profiling. We turn real-world data into actionable insights that power smarter credit, risk, and engagement decisions. With proven technology, regulatory support, and global partnerships, AiGenix is redefining how insurers, banks, and enterprises make data-driven decisions.

Real-Time Intelligence for Banking

Track customer activity, transaction patterns, and location events in real time. Instantly trigger alerts to CRM, loan management, or notification systems for proactive engagement and fraud prevention.

Risk & Insurance Insights

Transform behavioral and contextual data into actionable insights for insurers. Enable accurate risk scoring, personalized underwriting, and dynamic pricing models that reward safer behaviors.

Process Automation & Smart Alerts

Automate claims handling, credit checks, and compliance reporting with intelligent workflows. Deliver predictive alerts and decision recommendations that help organizations act faster and reduce operational friction.

Why Choose AiGenix

Why Choose AiGenix

Precision & Insight — We translate real-world behaviour and environmental signals into usable risk scores, giving you deeper visibility into what truly matters.

Speed & Efficiency — Our API-first, SDK-driven platform automates workflows like credit checks, fraud detection, claims handling, and compliance reporting — saving time and reducing operational friction.

Regulatory Confidence — Designed to meet evolving data protection and insurance regulation standards, so your solutions stay compliant across jurisdictions.

Proven Impact — Our clients in insurance, banking, fleet, and mobility industries have achieved measurable improvements — from reduced claims costs to safer operations.

Scalable Integration — Flexible, modular tools that adapt to your tech stack; whether you need a single capability (e.g. risk scoring) or full-scale transformation, we can deploy accordingly.

Real-Time Intelligence for Banking

Track customer activity, transaction patterns, and location events in real time. Instantly trigger alerts to CRM, loan management, or notification systems for proactive engagement and fraud prevention.

Risk & Insurance Insights

Transform behavioral and contextual data into actionable insights for insurers. Enable accurate risk scoring, personalized underwriting, and dynamic pricing models that reward safer behaviors.

Process Automation & Smart Alerts

Automate claims handling, credit checks, and compliance reporting with intelligent workflows. Deliver predictive alerts and decision recommendations that help organizations act faster and reduce operational friction.

Solutions Built For Transformation

Solutions Built For Transformation

From dynamic risk profiling to regulatory dashboards, AiGenix provides end-to-end tools for actionable insights.

UBI-Ready Pricing Integration

Integrate usage-based insurance pricing mechanisms directly into your product workflows.

UBI-Ready Pricing Integration

Integrate usage-based insurance pricing mechanisms directly into your product workflows.

Regulatory Reporting Alignment

Ensure risk models align with evolving data privacy laws and regional insurance regulatory requirements.

Regulatory Reporting Alignment

Ensure risk models align with evolving data privacy laws and regional insurance regulatory requirements.

Dynamic Risk Scoring

Generate adaptive scores based on driving style, mileage, vehicle type, driver age, and environmental conditions.

Dynamic Risk Scoring

Generate adaptive scores based on driving style, mileage, vehicle type, driver age, and environmental conditions.

Fraud Prevention Signals

Identify anomalies in behavior, travel patterns, or crash data that may indicate fraudulent claims.

Fraud Prevention Signals

Identify anomalies in behavior, travel patterns, or crash data that may indicate fraudulent claims.

Behavior-to-Risk Translation Engine

Convert raw driving behavior into precise risk tiers using machine learning models trained on millions of real trips.

Behavior-to-Risk Translation Engine

Convert raw driving behavior into precise risk tiers using machine learning models trained on millions of real trips.

Our Valued Clients

Our Valued Clients

We are trusted by leading clients in insurance, finance, and enterprise sectors. From AI-driven analytics to advanced risk solutions, our clients rely on AiGenix to power their growth, innovation, and security.

Our Business Partners

Our Business Partners

AiGenix has collaborated with various business partners for Technology, Actuarial Services and Logistics services across the globe.

Industries We Serve

Industries We Serve

Insurance |Banking | Public Sector and Regulators |Fleet

We address real-world risk, compliance, and operational challenges through AI-driven innovation.

Insurance

Smarter underwriting, fraud prevention, and faster claims through AI-powered behavioral insights & process automation.

Banking

Boost credit scoring and fraud prevention with location intelligence, and engage customers through real-time profiling and targeted marketing

Public Sector & Regulators

Enhance public safety and efficiency with telematics for fleet tracking, emergency response, traffic management, and infrastructure planning

Fleets

Lower costs and improve safety with predictive driver insights, trip analysis, and proactive fleet management.

Insurance

Smarter underwriting, fraud prevention, and faster claims through AI-powered behavioral insights & process automation.

Banking

Boost credit scoring and fraud prevention with location intelligence, and engage customers through real-time profiling and targeted marketing

Public Sector & Regulators

Enhance public safety and efficiency with telematics for fleet tracking, emergency response, traffic management, and infrastructure planning

Fleets

Lower costs and improve safety with predictive driver insights, trip analysis, and proactive fleet management.

Driving Innovation:

Real-World Success Stories

Driving Innovation: Real-World Success Stories

From startup fleets to enterprise insurers, our platform adapts to your industry’s unique challenges.

Insurance

40% Cost Reduction

Improve premium accuracy and streamline claims with telematics-driven automation and insights.

Fleet and Mobility

20% Fuel Savings

Optimize routes, cut fuel costs, and enhance driver safety with real-time fleet intelligence

Public Sector & Regulators

25% Faster Response

Ensure road safety standards with comprehensive monitoring and automated reporting systems.

Banking

10% Revenue Increased

Transforming customer data—such as location and spending—into actionable insights to deliver personalized products and increase revenue per customer.

Insurance

40% Cost Reduction

Improve premium accuracy and streamline claims with telematics-driven automation and insights.

Case Study

How LogiCorp reduced insurance premiums by 35% using our AI-driven risk assessment

Fleet & Mobility

20% Fuel savings

Optimize routes, cut fuel costs, and enhance driver safety with real-time fleet intelligence

Case Study

State Transportation Department streamlined safety audits across 10,000+ commercial vehicles

Public Sector & Regulator

20% Safety Response

Ensure road safety standards with comprehensive monitoring and automated reporting systems.

Case Study

Major automotive manufacturer embedded our SDK in 500K+ connected vehicles

Banking

10% Revenue Increased

Transforming customer data—such as location and spending—into actionable insights to deliver personalized products and increase revenue per customer.

Case Study

Regional insurer increased profitability by 25% with usage-based insure programs

150 Billion

KMs of driving data collected

362 Thousand

Accidents analyzed

2 Billion

Driving exceptions recorded

150 Billion

KMs of driving data collected

362 Thousand

Accidents analyzed

2 Billion

Driving exceptions recorded

GenixDrive – Smarter Driving. Safer families

GenixDrive – Smarter driving. Safer families.

GenixDrive is a premium smartphone application that empowers users to monitor their own driving behavior and keep loved ones safe on the road. By combining telematics data, advanced analytics, and family safety features, it provides actionable insights for safer journeys.

With consent-based family integration, real-time alerts, and intelligent driving summaries, GenixDrive turns everyday driving into a more informed and secure experience.

News & Updates

News & Updates

Stay updated with the latest developments in AI-powered mobility, telematics innovations, and industry insights from our experts.

Partnership Update: Delivering Smarter Fleet Solutions to the UK Public Sector

AiGenix Partners with Najm Company for Insurance Services to Expand Telematics Solutions Across GCC

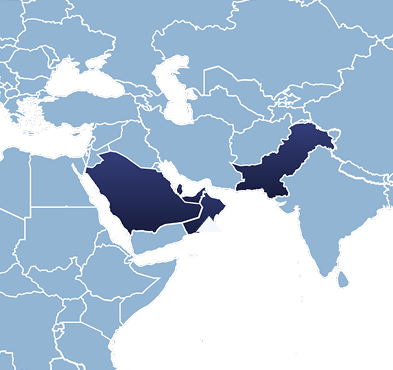

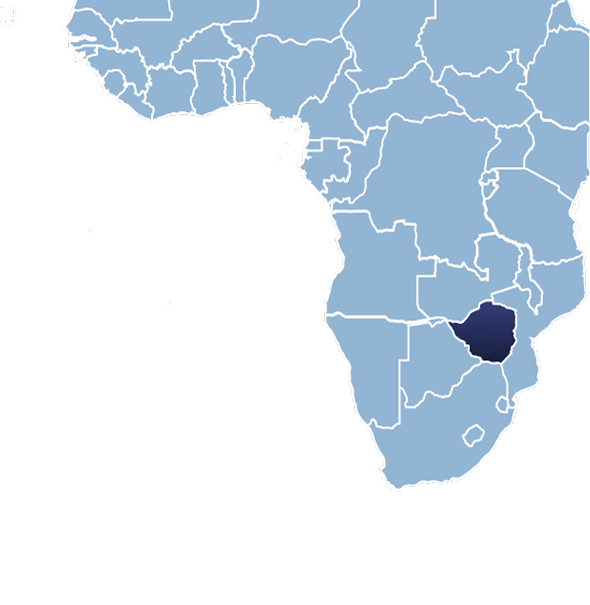

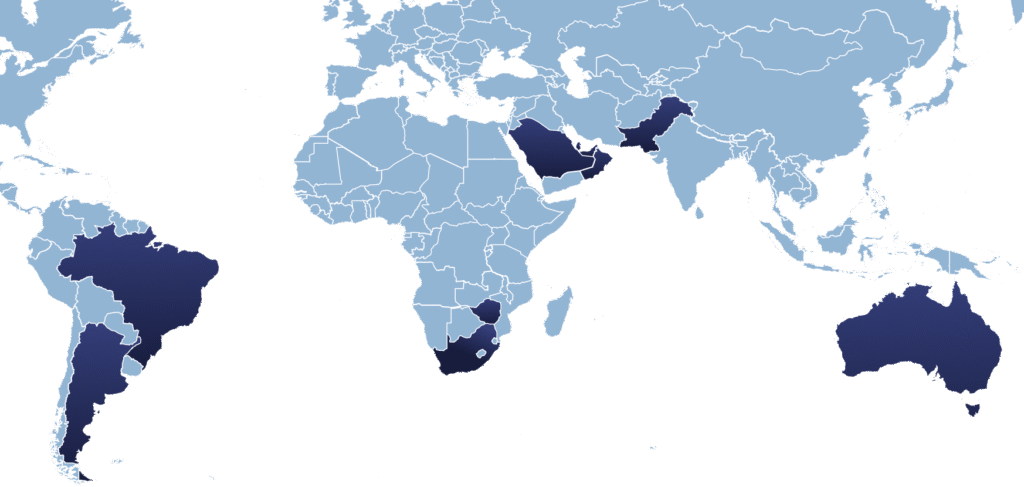

Our Network

Our Network

Serving clients across the globe

Start Your AI Journey Today

Start Your AI Journey Today

Ready to reduce risks, improve road safety, and revolutionize mobility?

Transforming businesses with data-driven intelligence. Driving growth and efficiency through advanced analytics and behavioral insights.

Contact us

Email: contact@aigenix.ai

Location:

DUBAI – Head Office:

101, IFZA Dubai, Silicon Oasis, Dubai, UAE

KARACHI

The Centre, Plot#28, Sb-5, Abdullah Haroon Road, Saddar Karachi, Pakistan

© 2025 AiGenix. All rights reserved.